Top

Info

AI Insight

Vitals

Vitals

Pricing

Pricing

| Edition | Included AI Insight Requests with Subscription |

|---|---|

| Essential | 3 Requests / Month |

| Investor | 15 Requests / Month |

| Business | 75 Requests / Month |

Details

Details

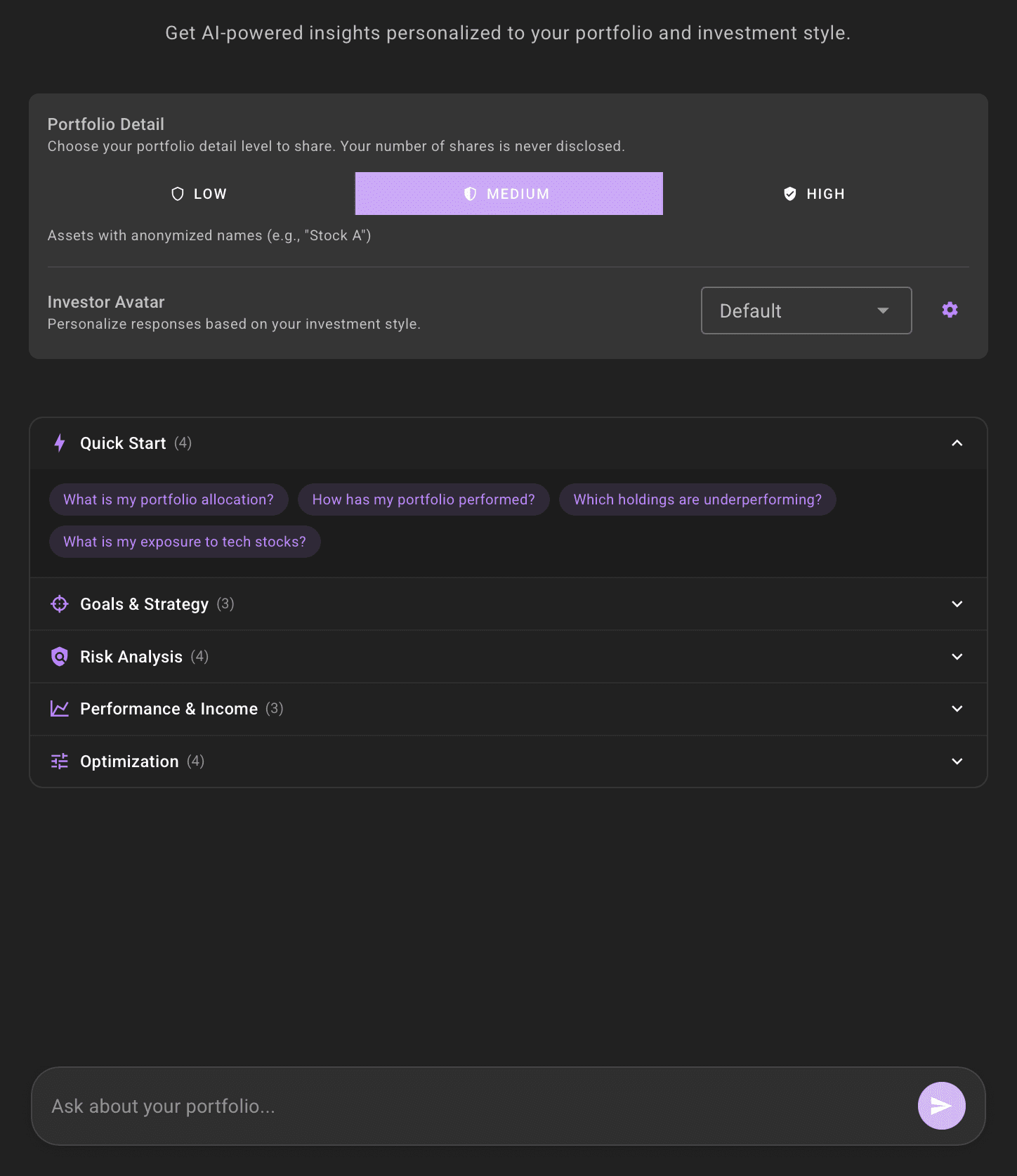

Privacy-First AI Insights

- Natural language queriesask questions about your investments in plain English and get intelligent, data-driven insights

- Custom portfolio queriesask anything from simple lookups to complex multi-factor analysis

- Real-time portfolio analysisget immediate AI responses and insights based on your current portfolio

- Privacy-first designthree privacy levels let you control what data is shared with AI

- Adjust the privacy for each new chatadjust what you share to match your comfort and analytical needs

- Level 1 - Allocations onlyshare only high-level allocations (stocks %, bonds %, cash %) with no asset details

- Level 2 - Assets Anonymizedincludes asset details but replaces tickers and fund names with generic IDs

- Level 3 - Assetsincludes actual tickers and fund names for detailed analysis

- Avatar-based profilescreate multiple investment personas (aggressive, balanced, conservative) to explore different strategies

- Share protectionyour number of shares owned is never shared with AI at any privacy level

- Data securityall AI interactions route through AssetView's secure infrastructure

- Market contextget AI-powered analysis of how market conditions may affect your specific holdings

- Performance deep-divesanalyze returns and understand what's driving your portfolio performance

- Investment strategy explorationexplore rebalancing and optimization scenarios, concentration risk, and diversification strategies

- Comparative analysiscompare different scenarios, time periods, or investment approaches

- Multi-scenario explorationswitch between Avatars to evaluate decisions from different investment perspectives

- Tax optimization insightsexplore tax-loss harvesting opportunities and tax-efficient investment strategies

- Investment educational depthAI explains complex concepts in simple terms tailored to your portfolio

- Contextual follow-upsbuild on previous responses for progressively deeper analysis and understanding

- Pre-built questionsstart with suggested investment questions or write your own custom queries

![]()

Overview

- AV App: AV AI Insight is an AV App built by AssetView.

- Real-Time Portfolio Analysis: AI responses are based on your current portfolio state, ensuring relevant and up-to-date analysis.

Steps

- Log in to your AssetView account

- Navigate to the AV AI Insight App from your dashboard

- Review the three privacy level options and choose the one that fits your needs

- (Optional) Create your first Avatar representing your primary investment approach

- Start your first chat with a suggested question or your own query

Privacy and Control

Your privacy and data security remain our top priority. All AI interactions route through AssetView's secure infrastructure.

For each new chat, AV AI Insight puts you in control of your what portfolio data is shared with the AI engine through three distinct privacy levels:

Note: Your number of shares owned is never shared with AI.

Level 1: Allocations Only

- Shares only your portfolio allocations (e.g., 60% stocks, 30% bonds, 10% cash)

- No asset-level information disclosed

- Perfect for general strategy discussions and high-level portfolio planning

- Most private option for exploring investment concepts

Level 2: Assets with Anonymized IDs

- Includes your portfolio allocations (e.g., 60% stocks, 30% bonds, 10% cash)

- Generic IDs for each asset replace the real IDs (e.g. ticker symbols, fund names)

- Enables general analysis of assets

- Useful for more comprehensive portfolio reviews without revealing asset IDs

Level 3: Assets with Real IDs

- Includes your portfolio allocations (e.g., 60% stocks, 30% bonds, 10% cash)

- Assets with real IDs (e.g. ticker symbols, fund names)

- Enables the most specific and detailed AI analysis

- Choose this for maximum analytical depth

Your Responsibility:

AssetView applies technical controls to limit the detail shared and to reduce the likelihood that shared data is personally identifiable; however, you control (a) the names and labels you assign to accounts and assets that may be included in AI prompts and outputs, and (b) the content of your AI conversations. Accordingly, you are responsible for ensuring that you do not include personally identifiable information (or other sensitive information) in account or asset names, labels, or chat messages that you provide to AI.

Avatars: Investment Profiles

- You may create multiple Avatars.

- Each Avatar represents a profile, a representation of a style of investing that you at times may adopt or want to explore.

- Create multiple Avatars to represent different investment philosophies.

- When you start a chat, you select the privacy level and an Avatar (or no Avatar if you wish) whose profile you want to accompany the Portfolio AI Share.

Examples of Avatars

Aggressive Growth Avatar

- High risk tolerance, growth-focused strategy

- Explore high-return opportunities and concentrated positions

- Ask questions about emerging sectors, individual stock potential, maximum growth scenarios

Balanced Avatar

- Moderate risk tolerance, diversified approach

- Your default investment philosophy

- Evaluate balanced strategies, risk-adjusted returns, steady wealth building

Conservative Avatar

- Low risk tolerance, capital preservation focus

- Emphasize stability, income generation, downside protection

- Explore bond allocations, dividend strategies, risk mitigation

Why Use Avatars?

- Explore scenarios from different risk perspectives

- Compare how the same portfolio might perform under different investment philosophies

- Separate your day-to-day investing approach from exploratory analysis

- Test strategies without committing to implementation

What You Can Ask

The AI Assistant can help with a wide range of investment questions. You may click on one of the investment questions that AssetView provides or write your own question.

Example Questions: the scope and depth of analysis will depend on the privacy level that you choose

Portfolio Analysis

- "What's my current asset allocation?"

- "How diversified is my portfolio?"

- "Which holdings have the highest concentration?"

- "Do I have overexposure to any particular sector?"

Performance Insights

- "What's driving my portfolio performance this year?"

- "How do my tech holdings compare to each other?"

- "Which positions have the best risk-adjusted returns?"

- "What are my top 5 performers over the past 6 months?"

Strategy Exploration

- "Should I rebalance my portfolio?"

- "What are some diversification opportunities?"

- "How might rising interest rates affect my holdings?"

- "What would happen if I increased my international allocation?"

Tax Optimization

- "Do I have any tax-loss harvesting opportunities?"

- "Which holdings are most tax-efficient?"

- "What are the tax implications of rebalancing?"

- "Should I consider selling any positions before year-end?"

Investment Education

- "Explain my portfolio's beta in simple terms"

- "What does my Sharpe ratio tell me about my risk-adjusted returns?"

- "How does dollar-cost averaging work with my holdings?"

- "What's the difference between my sectors and asset classes?"

Maximizing Your Experience

- Be specific - "Analyze my tech sector allocation" beats "Tell me about my stocks"

- Provide context - Mention your goals, timeframe, or specific concerns

- Ask follow-ups - Build on previous responses for progressively deeper insights

- Experiment with privacy levels - Higher levels enable more detailed, specific analysis

- Create strategic Avatars - Explore the same question from different investment perspectives

- Be mindful of privacy - Review what you're sharing at each privacy level

Important Limitations

AV AI Insight Provides:

- Data-driven portfolio analysis

- Educational explanations of investment concepts

- Identification of potential opportunities

- Comparative analysis across holdings

- Scenario exploration and strategic discussion

AV AI Insight Does NOT Provide:

- Financial advice or regulated investment recommendations

- Trade execution or portfolio modifications

- Predictions or guarantees about future performance

- Legal or tax advice (consult qualified professionals)

Remember:

- AI responses are informational and educational, not financial advice

- Always verify important information independently

- Consult a licensed financial advisor for personalized recommendations

- AI analysis is based on the data you provide and general market knowledge

- Responses may vary between sessions (AI is probabilistic)

Ask questions about your portfolio in plain English

Get AI data-driven answers and deep investment insights today