Easy Startup

Easy Startup

- Connectors for automatic investment updates (optional)sync your account, asset, and transactional data from brokerage and bank accounts; AssetView is read-only and can never move money

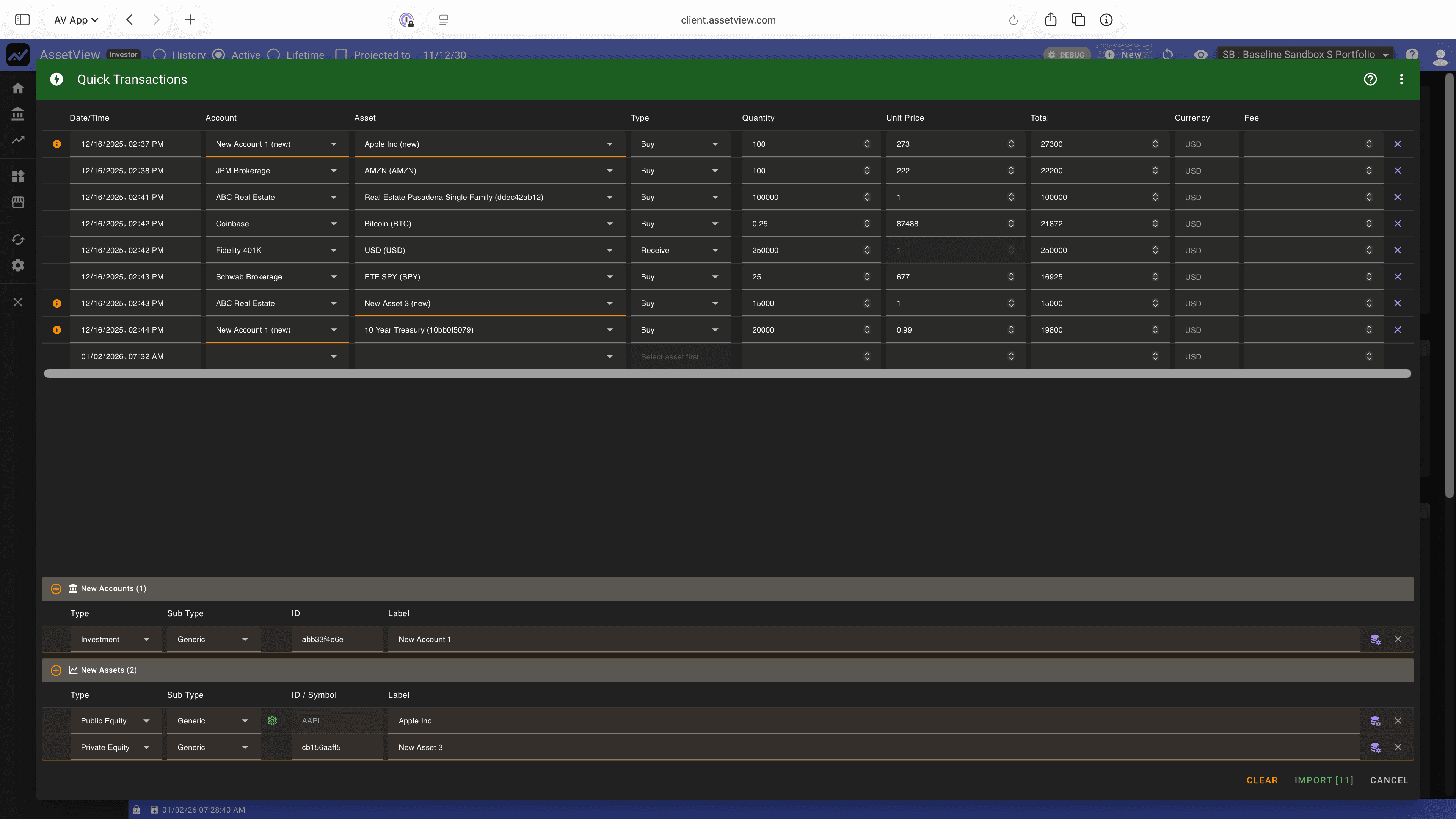

- AI assisted import (optional)import account, asset, and transactional data from a CSV, XML, JSON, Excel or Text file

- Quick Adddirectly enter your investments easily and quickly into AssetView

Clarity for Success

Clarity for Success

- Automatic updates (if you want it)updates from your financial institutions

- Easily customized data slicinganalyze a multitude of aspects starting with risk and liquidity

- Zoom lensglide between wide-angle portfolio survey and investment micro-tuning

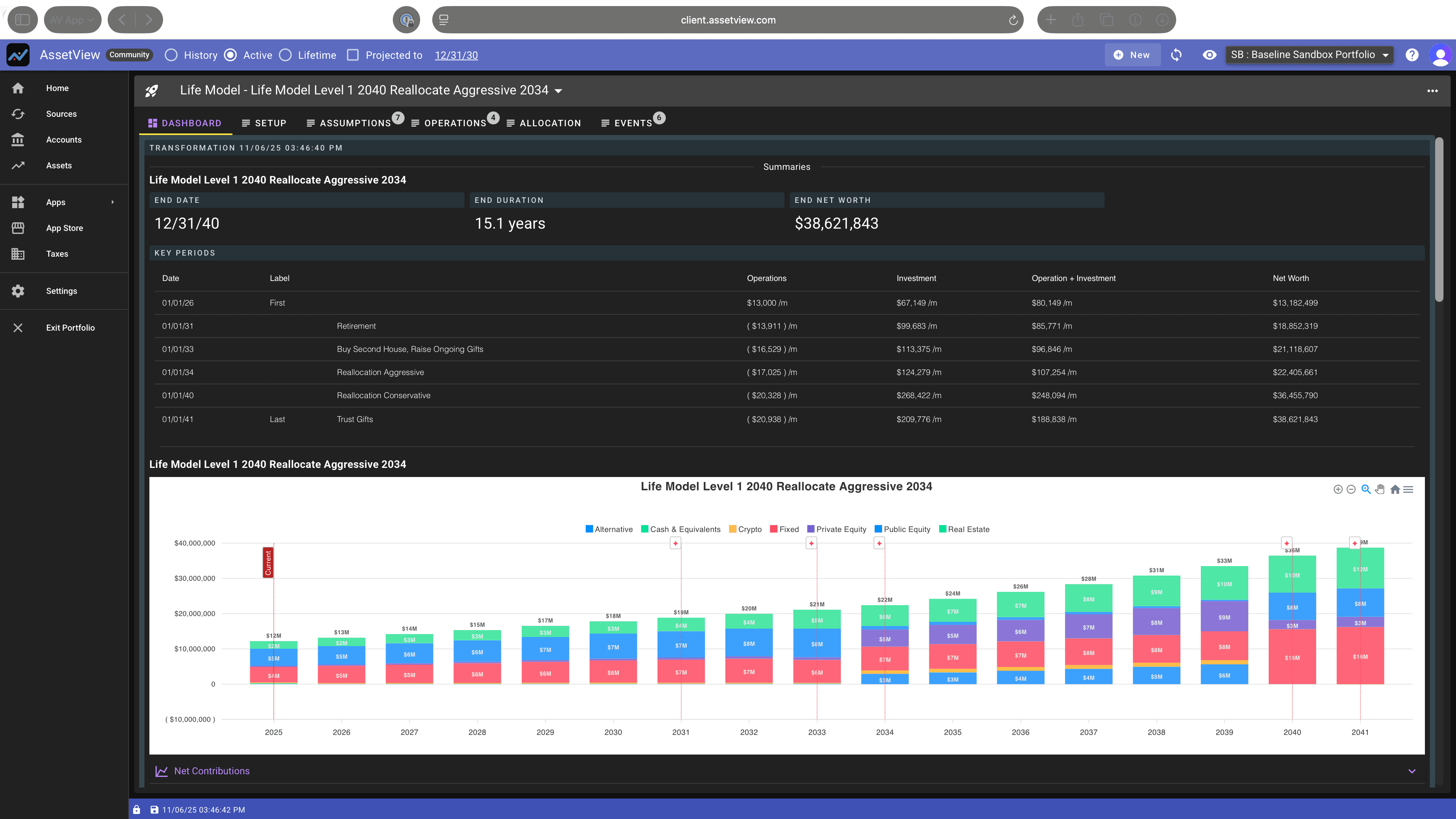

- Number crunchleverage financial gymnastics equipment with the power to number crunch through investment planning permutations

- Elastic planning environmentLife Planner that blends transactional and formula-driven planning

Deep performance insights

Deep performance insights

- Performance metricsinternal rate of return, multiple-on-money, cash flow, gain, unrealized gain, income, and profit potential

- Performance at every level of the rolluphistorical, current, and projected performance based on financial parties, accounts, assets, lots, and transactions

- Structured views by asset classspecific, detailed views (e.g. unfunded commitments on private funds, multiple calls for bonds)

- Scenario evaluationcurrent versus planned performance to know when to sell an asset and optimize your return

- Tax efficiency and tax loss harvestingcost basis and unrealized gain by asset by lot (including crypto wallets)

Intelligent tools

Intelligent tools

- Manage liquiditycash balances today and on any future date to optimize return and fund planned investments

- Manage performanceinternal rate of return, multiple-on-money, cash flow, gain, unrealized gain, income, and profit potential

- Manage risk, diversification, and morecurrent and projected portfolio risk, diversification, and balancing across booked, pending, and planned transactions

- Manage entriesplan investments and specific transactions; see the effects on future portfolio performance, cash flow, and balancing

- Manage exits and tax liabilityplan divestitures and maturing investments; minimize your current and projected tax liability

Make it yours

Make it yours

- Tailor your viewswith configurable dashboards

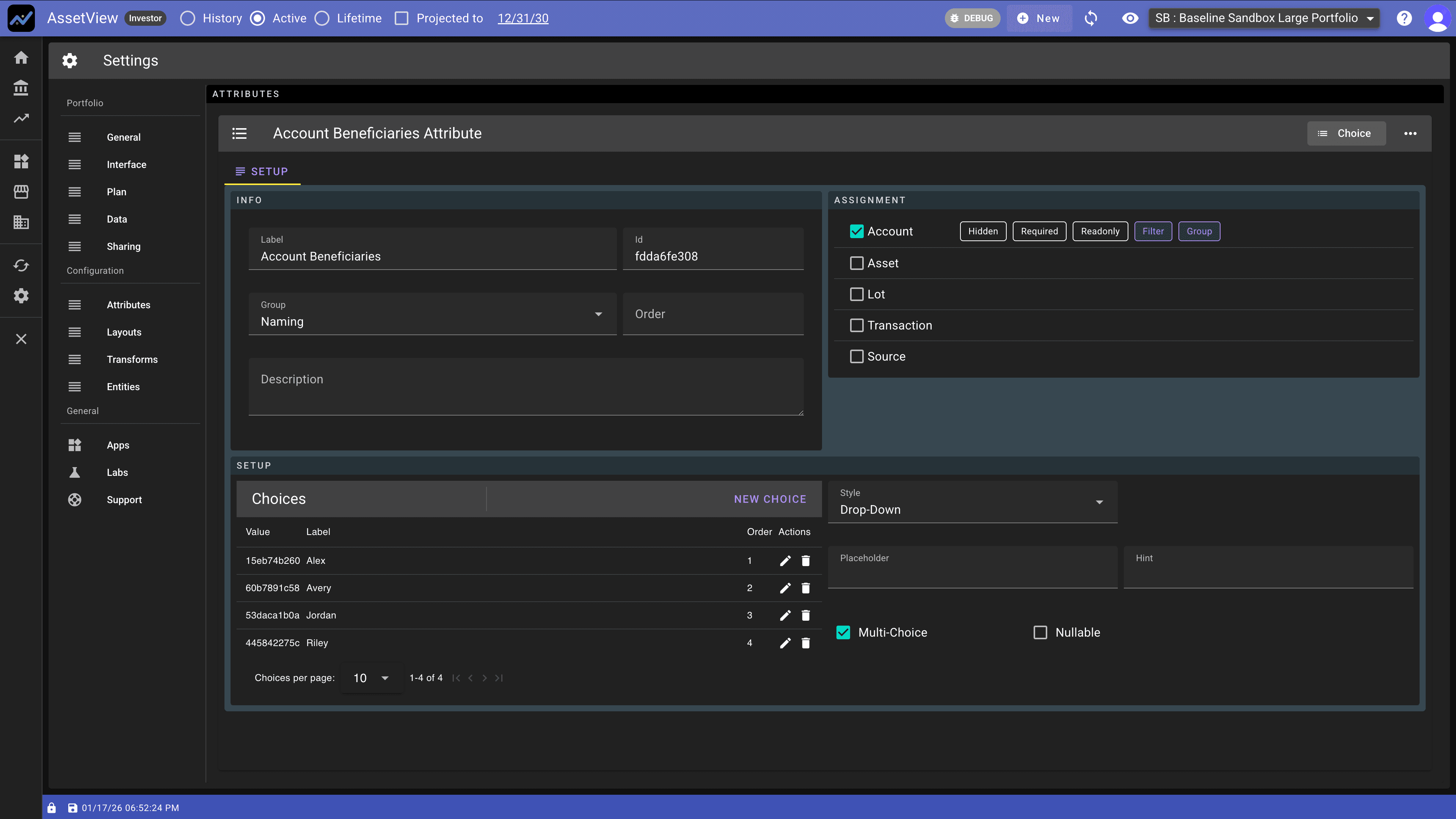

- Customize your attributeson accounts, assets, and lots

- Create situation-specific viewsfrom big-picture wealth summaries to deep analytics for investment analysis

- Choose your workflow with Appsthat modify, extend, or create additional functionality in AssetView

The Fundamentals

dedicated to your financial success

Private

Your personal investment data is yours

Secure

Our approach and toolset are constantly evolving with the ever-changing dynamics of data security

Smart

Insight that helps you make superior investments

Flexible

Highly adaptable to meet requirements

Practical

Built by investors, for investors

Scalable

Manages enterprise volumes and complexities

Clarity

One clear view across accounts, investments, and managers

Control

Visibility into cash flows, tax impacts, and performance

Confidence

Make smarter decisions with complete information

Strategic and tactical planning in one place

Supports short-term investment tactics and long-term estate strategies

Automated

Sync and performance calculations

Time

Less effort managing documents and spreadsheets, more time living life